nebraska sales tax rate on vehicles

With a sales tax rate of 55 in Nebraska this means you are paying an additional amount equal to 55 of the vehicles value at the point of sale. 60000 Sales Tax Rate.

Sales Taxes In The United States Wikipedia

Kearney NE Sales Tax Rate.

. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. 1500 - Registration fee for passenger and leased vehicles. The average car sales tax for Nebraska is 6324.

The Nebraska state sales and use tax rate is 55 055. La Vista NE Sales Tax Rate. Nebraskas sales tax rates for commonly exempted items are as follows.

Registration Year Base Tax Amount 1. Lincoln NE Sales Tax Rate. Subsequent brackets increase the tax 10 to.

For example a county that charges 2 percent sales tax and 4 percent lodging tax would have a total tax rate of 55 plus 1 plus 2 plus 4 for a total of 125 percent tax rate. This table lists each changed tax jurisdiction the amount. Maximum Possible Sales Tax.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. This value includes both state and local taxes and the latter varies based on the county. Calculate Car Sales Tax in Nebraska Example.

Lexington NE Sales Tax Rate. Vehicles More 2022 Nebraska Sales Tax Changes Over the past year there have been 22 local sales tax rate changes in Nebraska. This applies to the total value.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. The NE sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Buying a car doesnt stop at the.

This is less than 1 of the value of the motor vehicle. Average Local State Sales Tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023.

A room that is 100.

Taxes And Spending In Nebraska

A Twenty First Century Tax Code For Nebraska Tax Foundation

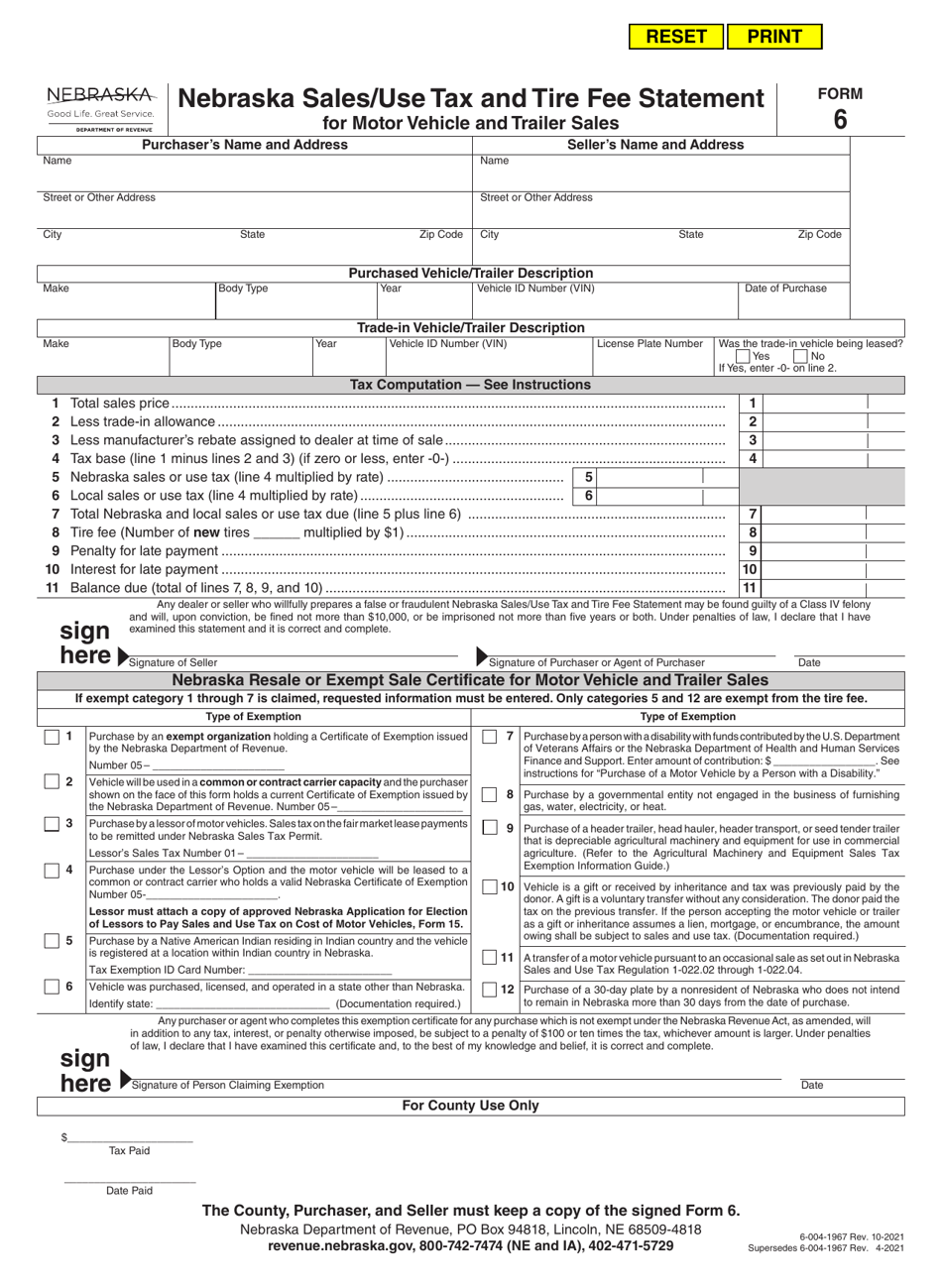

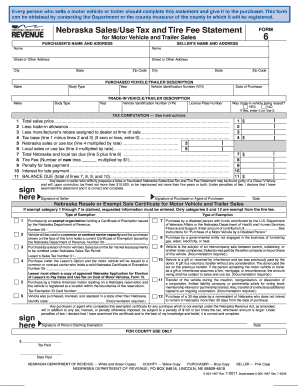

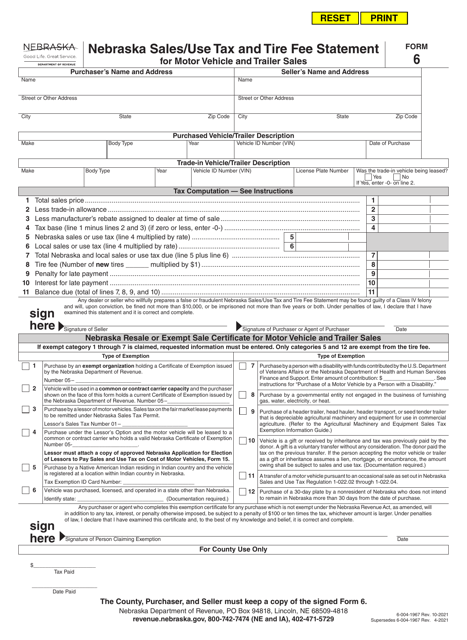

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

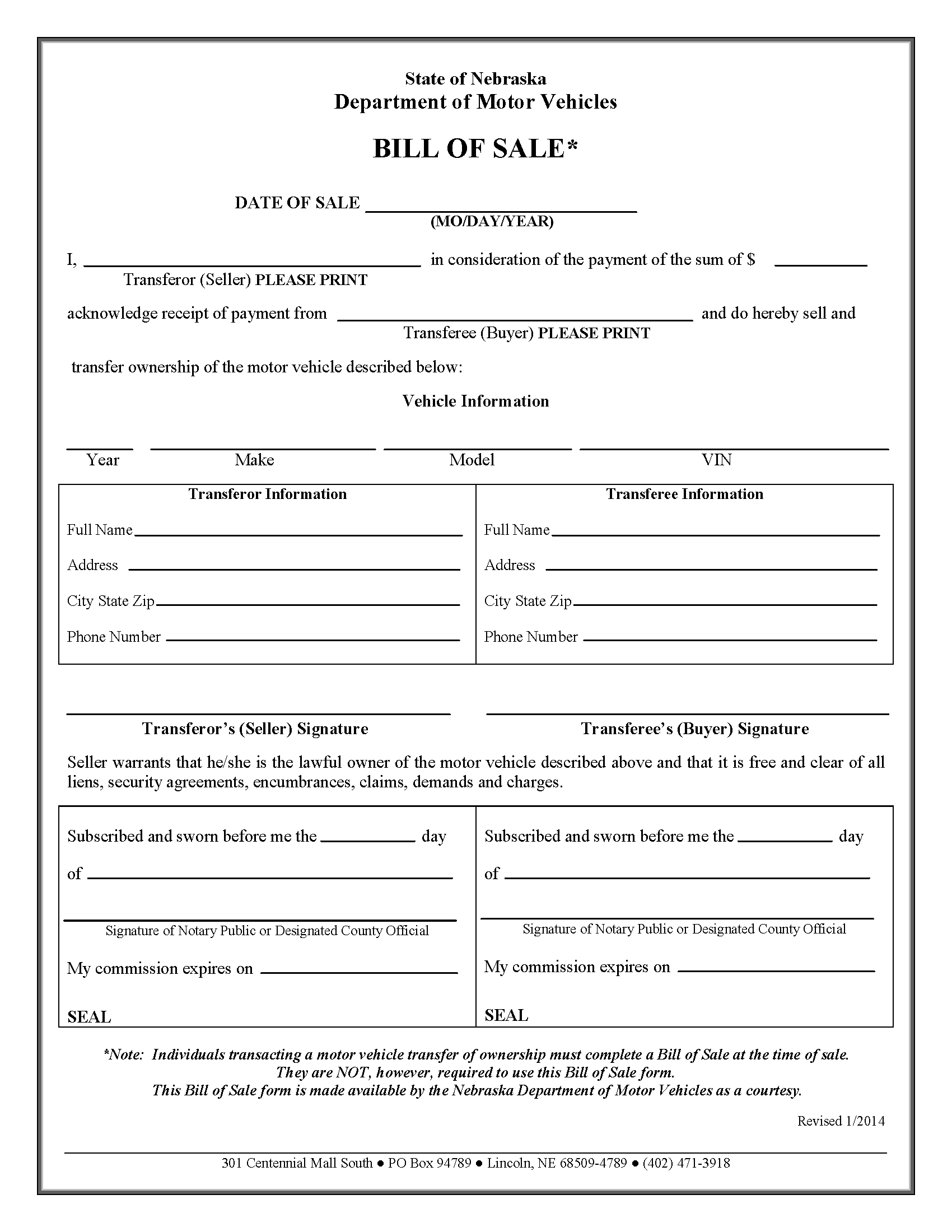

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

State Corporate Income Tax Rates And Brackets Tax Foundation

Welcome Nebraska Department Of Motor Vehicles

Used Cars In Nebraska For Sale Enterprise Car Sales

Vehicle Sales Tax Deduction H R Block

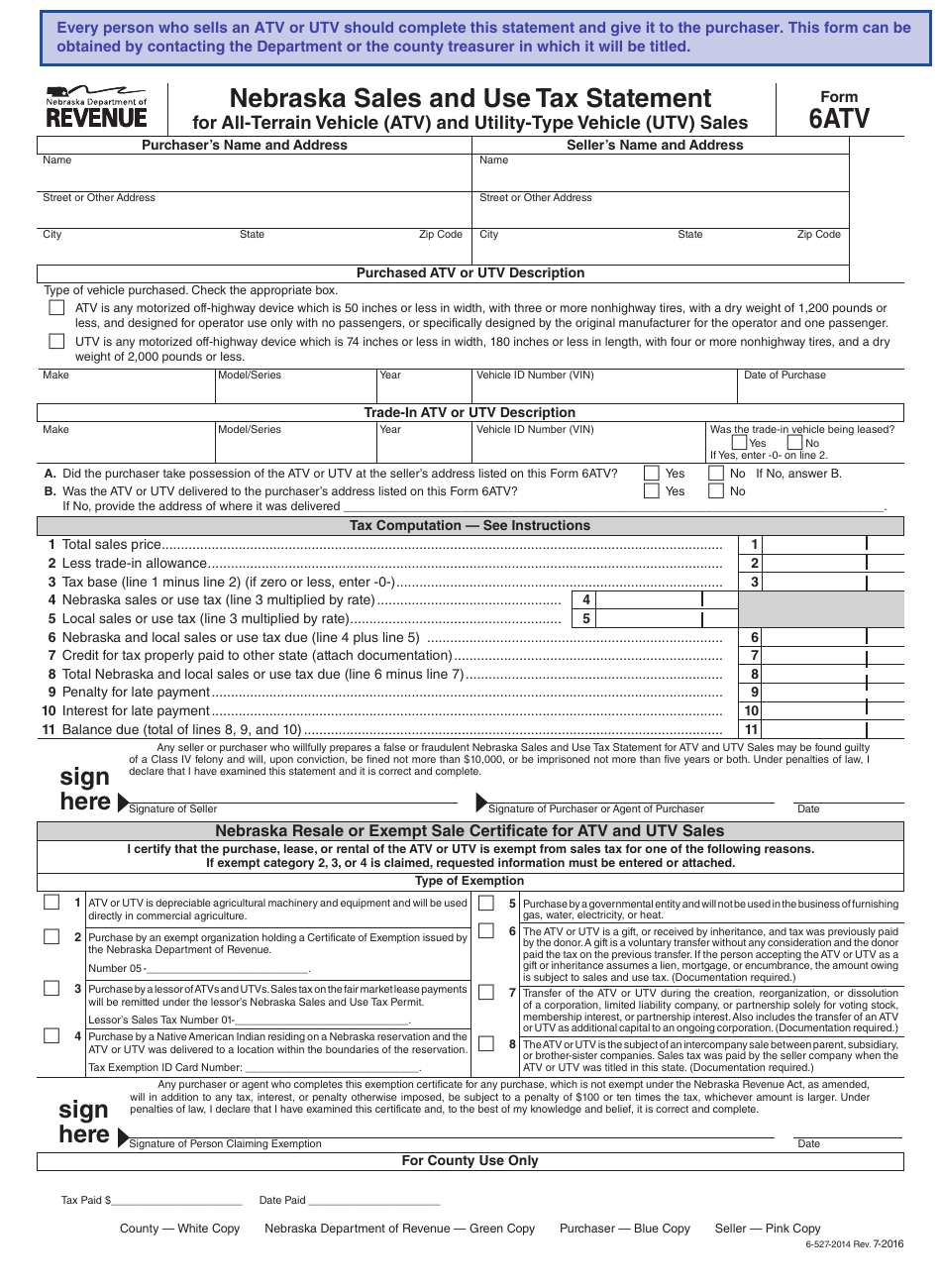

Form 6atv Download Printable Pdf Or Fill Online Nebraska Sales And Use Tax Statement For All Terrain Vehicle Atv And Utility Type Vehicle Utv Sales Nebraska Templateroller

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Sales Tax Laws By State Ultimate Guide For Business Owners

Form 6 Nebraska Sales Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 Fill Out And Sign Printable Pdf Template Signnow

Nebraska Sales Tax Small Business Guide Truic

Titles Nebraska Department Of Motor Vehicles

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Car Tax By State Usa Manual Car Sales Tax Calculator

State Income Taxes Highest Lowest Where They Aren T Collected