car sales tax wake county nc

Multiply the vehicle price after any trade-ins but before. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax.

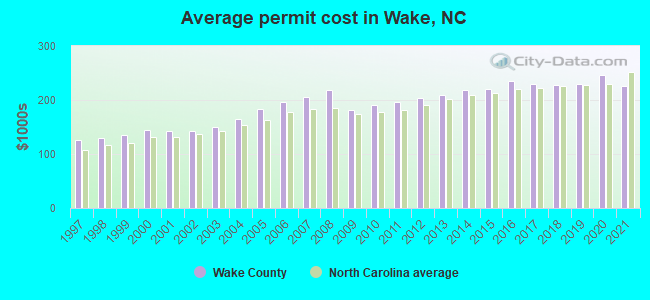

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Pay your tax bill by mail in person or online with bill pay your checking account or a credit card. Motor Vehicles are valued by year make and model.

In 2005 the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. 025 lower than the maximum sales tax in NC. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

The 2018 United States Supreme Court decision in South Dakota v. Johnston street smithfield nc 27577 collections mailing. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

The law transfers responsibility of. In North Carolina it will always be at 3. Using the tax bill search you can browse billing and payment information for real.

Pay a Tax Bill. The North Carolina state sales tax rate is currently. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. Sales tax in wake county north carolina is. 10 hours ago17 states weigh adopting Californias electric car mandate.

The Wake County sales tax rate is. Johnston Street Smithfield NC 27577. For vehicles that are being rented or leased see see taxation of leases and rentals.

Johnston County Tax Administration Office. Under the Clean Air Act states must abide by the federal governments standard vehicle emissions standards. DMV Title Registration Taxes Taxes North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is.

In addition to taxes. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. Sales and Use Tax Rates Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items.

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Wake County Nc Property Tax Calculator Smartasset

Raleigh North Carolina Nc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

North Carolina Nc Car Sales Tax Everything You Need To Know

2021 Infiniti Q60 Red Sport 400 In Wake Forest Nc Infiniti Q60 Crossroads Nissan Wake Forest

Wendell North Carolina Nc 27591 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Used Bmw Cars For Sale In Raleigh Nc Cars Com

2021 Chrysler 300s In Wake Forest Nc Chrysler 300 Crossroads Nissan Wake Forest

2019 Toyota Highlander In Wake Forest Nc Toyota Highlander Crossroads Nissan Wake Forest

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

.jpg?w=1600)

You Better Believe In Second Chances Wake County Man Wins More Than 200k In Nc Lottery Abc11 Raleigh Durham

Deputies Rash Of Luxury Cars Broken Into Stolen In Wake County Wral Com